In the competitive trucking industry, managing risks through comprehensive liability insurance for small fleets is crucial for long-term success. Commercial fleet insurance offers tailored solutions with multi-truck liability policies and cargo liability coverage, protecting businesses from financial losses due to accidents or damage. Effective dispute management and robust fleet liability coverage are vital for thriving in this intense market, allowing operators to maintain operational integrity and asset protection through affordable and specialized insurance plans.

In the dynamic world of trucking and fleet operations, understanding and effectively managing liability claims is paramount. This article guides you through the intricate landscape of liability disputes, focusing on small fleets and commercial operations. We explore the crucial role of liability insurance for small fleets, delving into various fleet liability coverage options designed to protect businesses and drivers alike. Additionally, we uncover strategic dispute resolution techniques to mitigate financial risks associated with trucking business liability and cargo liability insurance. Discover how to navigate these complex issues, ensuring the longevity and success of your fleet operations through suitable commercial fleet insurance and affordable fleet insurance solutions.

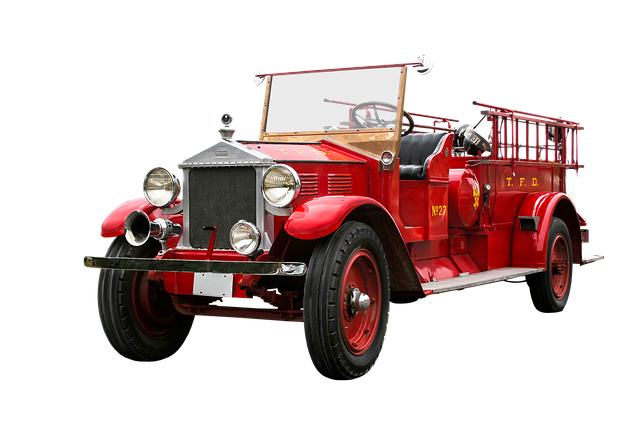

Understanding Liability Claims and Disputes in Trucking and Fleet Industries

In the trucking and fleet industries, understanding liability claims and disputes is paramount for businesses aiming to operate efficiently and sustainably. Fleet owners and managers must be aware that their operations expose them to various risks, from accidents involving their vehicles to cargo damage or loss. Liability insurance for small fleets plays a crucial role in mitigating these risks by providing financial protection against potential claims. Affordable fleet insurance policies often include comprehensive liability coverage, ensuring that businesses are shielded from significant financial losses that could arise from these incidents.

Commercial fleet insurance is designed to offer tailored protection for trucking businesses of all sizes. This includes multi-truck liability policies that cover a fleet’s vehicles and operations under various scenarios. Cargo liability insurance is another essential component, safeguarding against claims related to damaged or lost goods during transit. By securing adequate fleet liability coverage, small fleet operators can ensure they have the resources needed to resolve disputes effectively, maintain business continuity, and protect their financial health in an increasingly competitive industry.

The Role of Liability Insurance for Small Fleets and Commercial Operations

Liability insurance plays a pivotal role in protecting small fleets and commercial operations from financial ruin due to accidents or cargo damage. For trucking businesses, having robust fleet liability coverage is essential to mitigate risks associated with on-the-road incidents. Affordable fleet insurance policies cater specifically to the needs of smaller operations, offering comprehensive protection that includes both vehicle and cargo liability.

Commercial fleet insurance policies are designed to provide multi-truck liability protection, ensuring that business owners are covered should any of their vehicles be involved in an accident or suffer damage. This coverage extends beyond traditional auto insurance, addressing specific risks faced by trucking businesses, such as cargo liability. By investing in quality fleet liability insurance, small fleet owners can safeguard their assets, minimize financial losses, and maintain the integrity of their operations.

Types of Fleet Liability Coverage: Protecting Your Business and Drivers

In the realm of trucking and commercial fleets, effective dispute resolution and managing liability claims are paramount to the success and longevity of any business. The right fleet liability coverage acts as a robust shield, safeguarding both the company and its drivers from potential financial burdens. Understanding the various types of insurance designed for small fleets is key to making informed decisions that align with your specific needs.

One such essential coverage is commercial fleet insurance, which offers comprehensive protection tailored to the unique risks associated with multi-truck operations. This includes liability insurance small fleets specifically designed to cover damage or losses involving cargo, vehicles, and third parties. Trucking business liability policies may also include provisions for medical expenses, legal fees, and compensation for injured parties. For businesses dealing in valuable cargo, cargo liability insurance is crucial, ensuring protection against claims related to goods-in-transit. Moreover, multi-truck liability policies enable businesses to bundle coverage, offering not only cost savings but also streamlined management of multiple vehicles under a single policy. Such policies are particularly beneficial for small fleets seeking affordable fleet insurance without compromising on comprehensive protection.

Strategies for Effective Dispute Resolution and Mitigating Financial Risks

Effective dispute resolution is a cornerstone for any successful trucking or fleet business. By implementing robust strategies, operators can mitigate risks and protect their financial stability. One key approach is to foster open communication channels between all stakeholders—from drivers to customers—to address concerns promptly. This proactive engagement can prevent minor issues from escalating into costly legal battles.

Additionally, securing comprehensive liability insurance tailored for small fleets is indispensable. Policies like commercial fleet insurance, cargo liability insurance, and multi-truck liability policies offer protection against financial losses arising from accidents, property damage, or cargo damage. An affordable fleet insurance plan with adequate coverage can serve as a shield, ensuring that your trucking business remains resilient in the face of potential claims.

In the dynamic worlds of trucking and fleet management, effectively resolving disputes and managing liability claims is key to sustainable success. By understanding the nuances of liability in these industries, leveraging tailored liability insurance for small fleets, and employing strategic dispute resolution techniques, businesses can protect their operations, drivers, and investments. With the right combination of comprehensive fleet liability coverage and proactive risk mitigation, commercial fleet owners can navigate challenges with confidence, ensuring a safer, more prosperous future. Whether focusing on affordable fleet insurance or specialized cargo liability protection, these measures are essential for any trucking business aiming to thrive in today’s competitive landscape.