Trucking businesses operate in a highly regulated environment where managing trucking business liability is crucial. By employing technology like digital tracking platforms, data analytics, and automated claim processing systems, companies can streamline procedures, enhance operational efficiency, and gain financial control. Advanced software enables efficient claims management, reducing costs and expediting settlements while improving customer satisfaction and regulatory compliance. Although initial challenges exist, the benefits of implementing these technological solutions far outweigh the obstacles, leading to more secure and profitable trucking operations.

In the dynamic landscape of trucking, managing liability claims efficiently is paramount. This article delves into the intricacies of trucking business liability, exploring how technology serves as a game-changer in streamlining processes and enhancing accuracy. We dissect the role of digital tools in navigating complex claims, highlighting benefits and challenges. By understanding the basics of trucking business liability and embracing innovative solutions, operators can revolutionize their claim management strategies.

Understanding Trucking Business Liability: The Basics

Trucking businesses operate in a highly regulated industry, where understanding and managing liability claims are paramount to success. Trucking business liability encompasses a wide range of potential risks, from accidents involving cargo or vehicles to property damage and personal injuries sustained on or off the premises. Effective management involves recognizing these risks, implementing robust safety protocols, and establishing clear processes for handling claims efficiently and accurately.

Technology plays a pivotal role in streamlining this process. Digital platforms offer real-time tracking of vehicle movements, cargo conditions, and driver behavior, enabling proactive risk mitigation measures. Advanced data analytics can identify patterns indicative of higher liability risks, while automated claim processing systems reduce manual effort, minimize errors, and expedite settlements, ultimately enhancing operational efficiency and financial control for trucking companies.

Technology's Role in Efficient Claims Management

In today’s digital era, technology plays a pivotal role in revolutionizing how trucking businesses manage liability claims. By leveraging sophisticated software solutions and automation, companies can streamline their claim processes, enhancing efficiency and accuracy. Digital platforms enable real-time tracking of claims, from initial report submission to resolution, providing a transparent view for all stakeholders.

Through advanced data analytics, these systems identify patterns in liability claims, helping trucking businesses proactively manage risks. Automated data capture and digital documentation reduce manual effort, minimize errors, and expedite claim settlements. This not only improves customer satisfaction but also ensures compliance with regulatory requirements, fostering a more organized and responsive approach to managing trucking business liability claims.

Implementing Digital Tools for Streamlined Processes

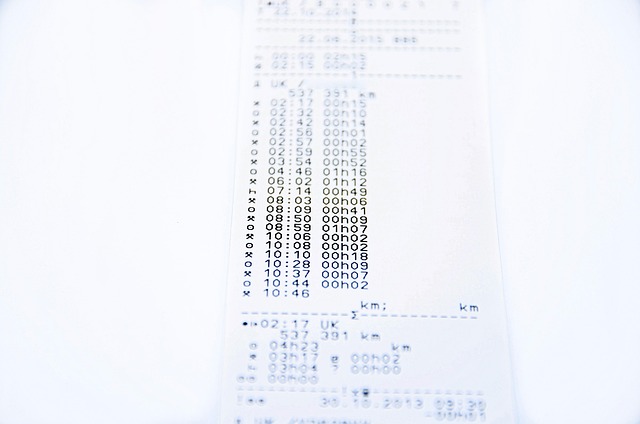

In today’s digital era, the trucking industry is witnessing a significant transformation in managing liability claims through the implementation of advanced technology. Digital tools offer a streamlined approach to processes that were once cumbersome and time-consuming. By utilizing specialized software, trucking businesses can efficiently track and manage liability claims, ensuring prompt responses and accurate record-keeping. This shift towards digital solutions enhances overall operational efficiency, allowing companies to focus on core activities while minimizing administrative burdens.

For instance, digital platforms enable real-time updates on claim status, facilitating better communication between insurers, claimants, and the trucking company. Automated data entry reduces human error and speeds up the verification process. Additionally, these tools provide a centralized repository for important documents, making it easier to access and manage evidence related to accidents or damages. As a result, the entire claims management process becomes more transparent, predictable, and effective, ultimately benefiting both businesses and their customers in terms of reduced costs and faster settlement times for trucking business liability claims.

Benefits and Challenges: A Balanced Perspective

Using technology to track and manage liability claims in a trucking business offers significant benefits, streamlining processes and enhancing efficiency. Digital systems allow for real-time data tracking, enabling swift identification of potential risks and proactive management. Automated claim processing reduces manual errors, accelerates settlement times, and improves overall communication between carriers, shippers, and insurance providers. Moreover, digital platforms provide transparent access to claim history, facilitating better decision-making and risk assessment strategies for trucking businesses.

However, embracing these technological advancements also presents challenges. Data security and privacy concerns are paramount, as sensitive information must be protected from cyber threats. Additionally, the initial implementation cost and learning curve associated with new software can be steep, particularly for smaller trucking operations. Ensuring data accuracy and integrating diverse systems seamlessly require careful planning and ongoing support. Despite these hurdles, a balanced perspective reveals that the benefits of technology in managing trucking business liability claims outweigh the challenges, paving the way for more efficient, secure, and profitable operations.

In conclusion, technology plays a pivotal role in enhancing the efficiency of claims management within the trucking business liability sector. By implementing digital tools, companies can streamline processes, reduce costs, and improve overall operational effectiveness. While challenges exist, such as data privacy concerns and initial implementation costs, the benefits—including enhanced accuracy, faster settlement times, and improved customer satisfaction—outweigh these drawbacks. As the trucking industry continues to evolve, embracing technology will be key to staying competitive and navigating the complexities of liability claims management.